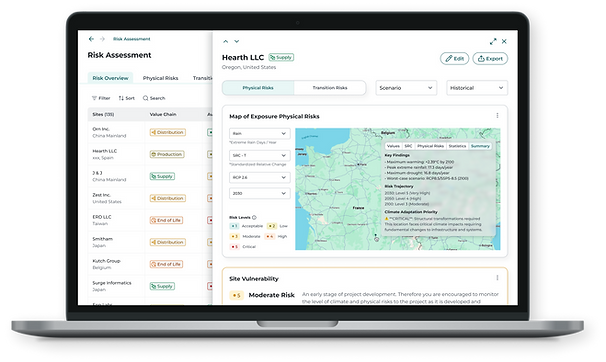

ESG and GRC risks assessments

Our ESG and GRC risk-assessment engine is designed from the ground up to answer a different question: how do ESG risks affect your sites, suppliers, customers and investors — and what is the smartest way to adapt?

Supporting your ESG and GRC risks with our our tools which turn raw data into clear, defensible signals you can act on.

Environmental risks

Climate, Nature, Resources and Water risks

Environmental risks involve climate change, resource depletion, water, pollution, and biodiversity loss risks.

Our platforms cover 42 indicators related to environmental risks and can build your own environmental risks

We combine environmental risks on physical sites, supply chains and portfolios – not just at corporate level. The goal is to protect assets, revenues and ecosystems in the same model.

For businesses, these risks can manifest as regulatory penalties for non-compliance with environmental standards, increased operational costs due to resource scarcity, or disruptions caused by climate-related events such as floods or hurricanes.

Social risks

Social risks pertain to how a company manages its relationships with employees, communities, and consumers. Poor labour conditions, human rights violations, or neglecting employee health and safety can result in labour strikes, legal action, and a damaged reputation.

This translates into losing customer trust and potentially lowering sales as consumers increasingly hold businesses accountable for their social impact. Failing to meet social expectations can make attracting and retaining talent difficult.

Emmy your AI sustainability Teammate

Your sustainability AI Teammate Emmy and its friends are here to support your risks compliance journey

-

With your knowledge database and our databased

-

Build on your tools and our expertises

-

Automate your workflow

-

Simplify your risks and compliance journey

-

Build your ESG risks indicators

Governance risks

Governance risks arise from inadequate corporate governance practices, including data privacy, AI governance, cyber, security, corruption, lack of transparency, and poor decision-making.

These risks often result in legal actions, financial mismanagement, and erosion of stakeholder confidence. Companies with weak governance may also find it harder to secure investments, as investors seek transparency and accountability in the companies they support. Some governance risks and particularly on AI risks can even forbid companies to sell their no compliant products on EU markets.

Our platform supports you to align your most urgent governance risks and especially the AI risks.

Mitigation, adaptation and compliance

Each ESG and GRC risks indicators (heatwaves, drought, flooding, soil degradation, biodiversity loss, regulatory risk, AI risks, cyber risks etc.) is directly linked to an action library:

-

Adaptation and mitigation solutions,

-

Capex/opex estimates

-

Impact trajectories both financial and no financial

-

Scenarios analysis combining several scenarios (action, no actions, prospective and retroactive)

-

Implementation roadmaps.

-

Directly integrating and aligning with global compliance laws